California Board of Accountancy

To protect consumers by ensuring only qualified licensees practice public accountancy in accordance with established professional standards. All consumers are well-informed and receive quality …

CBA - Licensure Applicant

Skip to Main Content Official website of the State of California 𝕏 Translate this site: Subscribe License Search Contact the CBA Settings Consumers Applicants Licensees Military/Refugees Outreach …

CBA - CPA Application

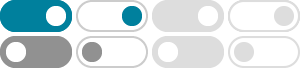

The CBA offers two methods for submitting your application for CPA licensure. Please consider the information below when determining what method best fits your needs.

CBA - Exam Applicant

Exam Applicant How to Apply for the CPA Exam on the CBA Website If playback doesn't begin shortly, try restarting your device.

CBA - California CPA License Application

By submitting this application for CPA licensure, you are acknowledging that you have read and understand the Rules of Professional Conduct adopted by the CBA.

CBA - Licensees

License Renewal Information about the upcoming fee increase Click here to renew your CPA, COR, or PAR license

CBA Fee Restructuring - Department of Consumer Affairs

A CBA member is elected annually to serve as the Secretary/Treasurer. Working with CBA staff and the Department of Consumer Affairs (DCA), the Secretary/Treasurer presents a financial report at CBA …

CBA - License Renewal Instructions

REGULATORY REVIEW COURSES Details on the new Regulatory Review Course at first renewal requirement List of CBA-approved courses

CBA - Initial Licensing FAQs - Department of Consumer Affairs

You can obtain the Application for CPA Licensure on the CBA website or by contacting the Initial Licensing Unit by email at [email protected] or by telephone at (916) 561-1701 and request …

CBA - Board-Approved Regulatory Review Courses

Board-Approved Regulatory Review Courses In order to maintain a license in an active status licensees must complete a Board-approved, two-hour regulatory review course once every six years. The next …